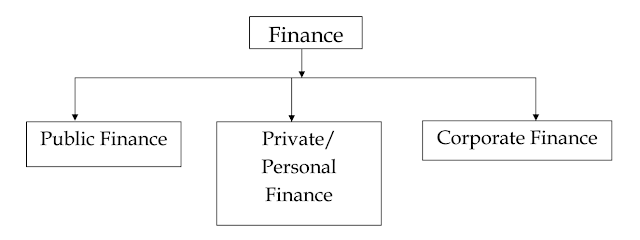

Types of Finance:

Generally, there are 3 types of finance:

1. Public Finance

2. Private / Personal Finance, and

3. Corporate Finance

Let's have a look at those three types of finance

1. Public Finance:

Public

finance can be defined as the study of government activities, which may

include spending, deficits, and taxation. The goals of public finance

are to recognize when, how and why the government should intervene in

the current economy, and also understand the possible outcomes of making

changes in the market. In addition, public finance can involve issues

outside of the economy, including accounting, law and public finance

management.

Understanding

the role of the government and how changes may affect the economy are a

few important aspects of public finance professionals. When the

government intervenes and takes action within the economy, the outcomes

are classified into one of three categories (which are called The components of Public Finance): economic efficiency, distribution of income or macroeconomic stabilization.

You may like:

The components of Public finance

2. Personal / Private Finance:

Personal finance is the process of planning and managing personal financial activities such as income generation, spending, saving, investing, and protection. The process of managing one’s personal finances can be summarized in a budget or financial plan. This guide will analyze the most common and important aspects of individual financial management.

Read More:

Areas of Personal/ Private Finance

3. Corporate Finance:

Corporate finance is the acquisition and allocation of corporation's funds, or resources, with the objective of maximizing shareholder wealth or we can say maximizing stock value. that means corporate finance is associated with maximizing firm value.

In the financial management of a corporation, funds are generated from various sources.

The sources of funds for a firm are:

1. New sources of funds

i) Issuing new securities to collect Equity capital, Debt capital and Hybrid Capital

ii) Taking a Bank Loan

2. Retained Earnings

3. Returns on Investments

The first function of corporate finance is known as resource acquisition, which refers to the generation of funds from both internal and external sources at the lowest cost to the corporation.

The second function of corporate finance is resource allocation. It is the investment of funds with the intent of increasing shareholder wealth over time. Two basic categories of investments are a current asset and fixed assets.

The current asset includes cash, inventory, and receivables. On the other hand, examples of fixed assets are buildings, real estate, and machinery. In addition, the resource allocation function is concerned with intangible assets such as goodwill, patents, workers and brand names.

Post a Comment